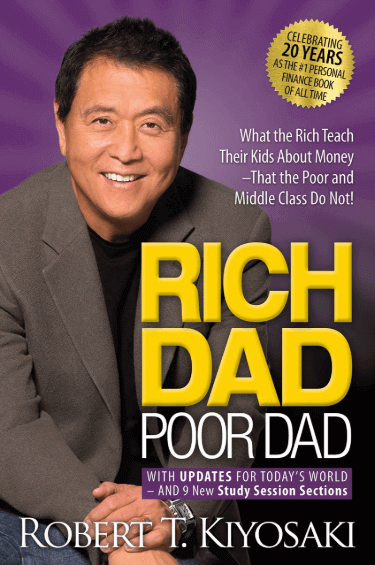

This summary of the “Rich Dad Poor Dad” by Robert Kiyosaki is worth reading because the lessons learned in this book promote healthy and successful perspective about money. This summary will also give you real life application on how to build and acquire income producing assets with low initial investment costs.

The main take away from this book is: “The Rich Spend Their Time and Money On Building & Acquiring Assets. The poor spend their time and money acquiring liabilities.”

Article: Get Cash Flow From Assets | Best Income Producing Assets To Invest In

This Rich Dad Poor Dad Summary will shift your paradigm about money, wealth and finances the way rich people think. This is not a get rich quick book. But rather it is a book that gives you an inside look to the thought process of rich person vs. a poor person.

Robert had 2 Dads teach him about money since a child. His biological father was the Poor Dad and his friend Mike’s father was the Rich Dad. They were both very hard working and smart. The Poor Dad had multiple college degrees and even a Ph.D. They both had successful careers, substantial incomes, were charismatic and influential…

The Rich Dad died leaving $10’s of millions of dollars to his family, churches, charities. The Poor Dad died leaving his family debt.

This happened because The Rich Dad and the The Poor Dad thought differently about money.

The “Rich Dad Poor Dad” Introduction Contrasts the different thought patterns of a rich person and a poor person.

Poor Dad: “The reason I am not rich is because of you kids.”

Rich Dad: “I need to find out how to be rich for you kids.”

Poor Dad: Discourage talking about money, business, and finance around the dinner table.

Rich Dad: Encouraged talking about money, business, and finance around the dinner table.

Poor Dad: “When it comes to risk it is better to play it safe.”

Rich Dad: ” Let’s learn how to manage risk.”

Poor Dad: ” Our home is our greatest investment and best asset.”

Rich Dad: “If you live in the house and are not renting out to make a profit each month, it is a liability.”

Robert’s poor dad gave him the advice; “…to be rich you have to learn how to make money.” So 9 year old Robert and Mike collected all the lead toothpaste tubes from their neighbors (this was 1956). They melted them down and made nickles with them. Robert’s poor dad sat down and told him about how counterfeiting money is illegal.

The poor dad suggested to meet with Mike’s dad to ask him how he manages and makes money. Mike’s dad is rich. In fact he is the “Rich Dad”.

The rich dad agrees to meet with Robert and Mike under strict conditions. He then offers them a job on every Saturday for 3 hours @ $.10 per hour and he will teach them how to be rich. Robert said he had a baseball games to play on Saturdays. But rich dad said take it or leave it. Robert chose to sacrifice playing to work and learn.

Robert & Mike both work for 3 hours per week @ $.10 per hour as agreed upon. Eventually Robert decided to quite because Rich Dad hasn’t taught him anything yet and is working like a slave.

So Robert goes to Poor Dad to quit. Robert was very angry and so was his Dad (Poor Dad). He said rich Dad was cheap and was violating child labor laws.

Rich Dad actually was making Robert angry on purpose to show him the lesson that life pushes you around and you have to learn how how to deal with it. Most submit and give up and stay in a poor mindset. But like Robert, some fight, blame and and complain. The good news about the fighter is He can learn to channel their anger into something positive. Anger plus love produces passion.

Poor people play it safe because they let fear govern their life. Rich people let passion make money decisions. As a result, poor people work for money and rich people have money work for them

Learning how to have money work for you is a life long study. A big part of that study is learning the nature of fear and desire. the desire drives you in and the fear drives you out. Rich people think about money logically and poor people think about money emotionally (fear/desire).

Emotion is not a bad thing. In fact it is defined as: energy in motion. It is what makes us human. The rich learn to use emotion to think, while the poor think with their emotions

Some rich people are motivated by fear, but except the fear of being poor, they fear losing everything.

Leaning how to master these dynamics of life takes a lifetime. Most people do not know how to deal with these life lessons and adopt psychotic mind sets. These psychotic mindsets cause people to horde money, adopt money avoidance lifestyles, and makes people who work 8 hours a day for money to say “I don’t care about money.” These psychotic tendencies must be uprooted from you life in order to to be truly rich.

It is important to learn to stop worrying about money and worrying about getting the next paycheck. one must be willing to work for free to learn or get access to resources. It is all about perspective and practicing not to make decisions based on fear, need and lack. Adopting this perspective results in opening doors to learning how to have money work for you instead of you spending your life working for money.

Future Mike continued to runs his Dad’s empire better than Rich Dad and is teach his kids to do the same. Robert end up retiring in his 40’s with assets so large they sustain themselves. Roberts says he watered it for years then one day it did not need him anymore. The roots were so deep and in place, the asset began to produce all on it’s own.

Many people ask Robert; What’s your secret? How do i make millions.” Robert is reminded of a 1923 a group of the Richest leaders and business men gathered together at Edgewater Beach Hotel in Chicago. Among them was Charles Schwab, the President of the New York Stock Exchange and 7 other big hitters.

25 years later a lot of them died broke or committed suicide. Think about it the great depression was in 1929.

We live in a time where things are changing faster than ever before. This is good reason for concern because many people think too much about money and they may have built a metaphysical/physical house on sand and if it lost may cause big time negative psychological consequences.

Being flexible, open minded and willing to learn is crucial for your sanity when it comes to money and life in general.

Having money without financial intelligence is money soon gone.

So when people ask Robert how to be rich they get disappointed because he simply says; “You must be financially literate.”

Accounting may be the most boring subjects but may be the most important long term knowledge to maintain wealth.

Luckily, having a strong accounting knowledge is not difficult. The simple principals can be taught to children. In fact Rich Dad did simple line drawings for Mike and Robert when they were pre-teens and as their empires grew their accounting knowledge became more sophisticated.

Knowing the difference between an asset and a liability is the 1st and only accounting rule you need to know. It seems to simple but it is time to KISS (Keep.It.Simple.Stupid).

Rich Dad said that rich people build and acquire assets ans poor people acquire things they thing are assets. As a result, the secret to being rich is learning what an asset is and learn how to acquire them. It’s that simple!

The reason not everyone acquires assets to become rich is they do not know the difference between an asset an a liability. It really only boils down to that simple concept. It is so simple that the concept escapes most. Do not let that happen to you!

This simple concept even passed the financially educated professionals. They were educated to see things through a scholastic mind set instead a of a real life practical yet simple financial truths.

There is literacy and financial literacy. If you look up the definition of “asset” and “liability” you may get confused, not because of your intelligence but because over educated literacy can confuse matters for what they are.

Don’t be proud, let’s learn something new and KISS. An asset puts money in your pocket and a liability takes money out of your pocket.

A lot of financial “professionals” disagree with this simple approach, but it really boils down to what works. Not what 1923 Charles Schwab thinks.

Take a look at the following simple diagrams that will teach you the foundation of your accounting knowledge. The arrows represent the flow of cash.

The top chart is the Income Statement. This is also known as a “Profit-and-Loss Statement. It measures income and expenses (money in, money out).

The bottom chart is the Balance Sheet and balances your assets and liabilities.

Most financial professionals do not even understand the vital relationship between an Income Statement and a Balance Sheet.

No that you This basic concept is really all you need to know about accounting. If you want to be rich just continue to build, acquire and buy assets.

Assets put money into your pockets weather you are working or not. This is called “Passive Income”.

As you can tell you do not have to be extremely smart to become wealthy. Thank God!

These visual aids are over simplified to give you a mental picture. Everyone has food, clothes and shelter expenses. Cash flow tells the real story when it comes to money.

Some people think that having more money would solve their financial problems, but sometimes it only compounds them. You hear about the lottery winners ans famous icons make millions only to become broke.

Even highly educated professionals like doctors have spent their whole life learning how to make and work for money. But they never learned how to mange their money and struggle in the long run. This is called financial aptitude.

You have two newly weds. they both just got out of college and are happy and ready to take on the world. They advance in their careers, their family grows everyone is happy!

But they realize that as their income went up so did their expenses. New car, bigger house, credit card debt, liabilities, utilities, toys etc…

They are now trapped in the rat race trying to keep up with all of the expenses and liabilities they have acquired. Financial literacy would have prevented them from running into this problem because they would have acquired assets instead.

To apply a rich mindset one must utilize the power of self-knowledge a decision making. It’s deciding to listen to that inner genius and wisdom instead of following the crowd.

The people who don’t listen to their inner wisdom and follow crowd believe and parrot things like: “Diversify”, “Your home is an asset.”, “Your home is your biggest investment”, “You get tax breaks for going into greater debt.”, “Get a safe job.”, “Don’t make mistakes.”, “Don’t take risks.”

The fear of being different is what prevents people from solving problems in new ways.

That fear keeps people in the mindset that says; “Play it safe.”, “Get a loan consolidation and get out of debt.”, “Work harder.”, “Some day i’ll be Vice President.”, ” Save money.” “When I get a raise I am going to buy a house.”, “Mutual Funds are safe.”

When Mike and Robert were 16 years old they began to separate from the crowd. not because they were bad, but because they did not follow how to crowd thought.

When you stop following the crowd you gain a new perspective that advantageous. For instance, at a young age Mike & Robert learned how learn from intelligent people. They learned that intelligent people hire people that are more intelligent that they are. Moreover, they learned that school forced people to follow a certain set of procedures and not deviate from the rules destroys creativity.

At a young age Mike and Robert began to understand why Rich Dad said that schools were designed to create employees, not good employers.

Many people challenge the fact that their home is not an asset. Emotions tend to run high when it comes to their home and money. Higher emotions about money, lowers financial intelligence.

Many people get excited about buying a home. so what happens is, in stead of building an investment portfolio or income generating asset they purchase a home they can barley afford and are trapped in a 30 year agreement.

Buying a home is a good thing. But when you understand the difference between an asset an a liability you will think like a rich person and build and acquire assets that can pay for that new home first…. Rich Dad Thinking

Poor Dad thinking always acquires liabilities that are bigger than their assets. and yes a home is an asset.

The rich build and acquire assets that are always bigger than their liabilities when you look at their financial statement. As a result there is always more money coming in than going out.

Their expenses tend to increase as their salary increases. They work for money their whole life but never build assets larger than their liabilities.

Many people say that mutual funds are safe, hence their popularity. Most mutual fund buyers are busy paying bills, taxes, kid’s school and many other things. As a result, it is hard for them to take time to gain more financial intelligence. So they purchase mutual funds as “safe” investments to “play it safe” and “avoid risks”. Financial illiteracy is the real risk.

Some say to work harder to get ahead. Nothing beats hard work. Except hard work combined with smart work. If you decide to put your head down and hard hard all of you life. You are respected highly. But there is a better way. Build and acquire those assets before you purchase that liability your are lusting for.

The real synergistic way to build your asset column is to take the excess profits generated from your current assets and investing it back into the assets column to make your current assets even larger.

Left Hemisphere Moment: Look at the numbers and learn how to read what story they are telling. Assets put money in your pockets. Liabilities take them away.

Right Hemisphere Moment: Balance sheets help give you a mental picture of where money flows in different people’s lives.

Sub-conscience Moment: The fear of being different and ostracized keeps people following the pack, never breaking through.

The owner of McDonalds made a speech at a college campus and asked the students what business he is in. Someone boldly said, “The hamburger business of course!” But Ray Kroc replied, ” I thought you would say that. No, i am in the real estate business.”

Today, McDonalds is the top real estate owner in the world. Who would have thought? He has real estate working in the background while everyone thinks hamburgers is his main deal. This is Rich Dad thinking.

This brings us to Lesson #3: Mind your own Business

Most people spend their lives working for someone else before they work for themselves. They work for their boss.

For instance, a Banker who does his job everyday does mind his won business. He is minding a much larger business. Which is fine, but it is important to have your own business too. Even if that business only generates passive income.

Your business revolves around you assets. It’s fine to be employed by a large company, don’t quit your job or anything. But it is time to use some of that income that work have it work for you. You can do that by building and acquiring assets.

Many people complain the “They need a raise!” But the reality is they need a financial foundation so they can take risks and have their money work for them (assets).

Our culture is so conditioned to the Poor Dad mentality that Robert tried to get a loan to purchase more real estate and they declined him because he made too much money on rental properties. They wanted to see that he made a salary as as professional like all the other “normal” people.

When people say that their net worth is $1 million or $100,000 Robert cringes because when you sell those assets you taxed on the gains.

Keep your daytime job and and start buying assets. Parents need to teach kids who are still at home the difference between a liability and real asset.

Anyone can be a rich dad with the correct mind set.

Poor Dad always taught Robert to do what you love. Rich Dad taught Robert build and acquire assets you love.

Today Robert enjoys starting companies, but no running them. And really enjoys real estate investment assets. Today there are more asset opportunities than ever before. The more financial literacy you have the better you are able to analyze income statements and balance sheets like a Rich Dad.

It is vital to look at each dollar as a little employee who is working for you. You do not want to take employees (money) out or your assets. And if you want luxuries make sure you buy them last. Rich people buy their flashy luxury items last. It’s like a reward.

After you have taken some time in building and acquiring assets. It is time to learn one of the biggest secrets of the Rich.

Left Hemisphere Moment: When assets generate enough to cover luxuries that’s when you can buy them.

Right Hemisphere Moment: Think creatively, not professionally.

Sub-conscience Moment: Acquire assets you love, you will take better care of them and enjoy learning about them.

Rich Dad always has seen Robin Hood (the one who steals from the rich and gives to the poor) as a thief. The reason the middle class is taxed so heavily is because of the Robin Hood mentality. Especially the upper-middle class.

Poor Dad was an expert at the history of education and Rich Dad was an expert in the history of taxes.

Rich Dad explained how there use to be no taxes. Taxes were only needed during a war. For instance, in 1861-1865 America used taxes to pay for the Civil War.

But then the government made it a permanent thing and eventually became legal by passing the 16th amendment. The whole motivation was to tax (punish) the rich.

But that approach only back fired be cause the government’s hunger for more taxes only grew and those taxes eventually had to paid for by everyone.

Rich Dad is a capitalist and poor dad is a bureaucrat. As a result, their success is is based on opposite behaviors.

In government large organizations are respected organizations. Bureaucrats get applause for being large and having a lot of employees. Capitalists get applause for creating organizations that have little to no employees because it costs less. This attracts investors.

Rich Dad avoids taxes and liabilities by using a Corporation as a vehicle to limit risk of their assets.

Utilizing a corporation as a vehicle to hold your assets is the best way to avoid taxes. Many people submit to all the taxes that come their way. This is the way of the poor. The Rich do their homework to learn how to avoid taxes in a legal way. They go out of their way and spend time learning the things they need to know.

If you own a corporation your Earn, Spend, Then Pay Taxes. If you work for a corporation you Earn, Pay Taxes and then spend. When a corporation spends before they pay taxes they have less taxable income. Hence less taxes to pay.

Left Hemisphere Moment: Accounting id financial literacy that requires more accuracy the more money you manage.

Right Hemisphere Moment: Investing is a science that involves formulas and creativity.

Sub-conscience Moment: Understanding the market of supply and demand is crucial. And the technical details are emotional.

We all have tremendous potential and are blesses with special talents and gifts. But the one thing that kills our progression in life is our self doubt. It is not a lack of technical education, it is a lack of self-confidence that keeps us from obtaining our goals.

When when there is too much fear in someone’s life the genius one possesses is then suppressed and makes no difference to others or themselves.

As you develop financial IQ it gives you more options and gives you more avenues to travel down to make money, or avoid having to pay too much money. But even with all of the financial IQ in the world, if you still have fear you will not make it as far. Boldness is key.

Many people work too hard because they cling to old ideas and never take that extra step to get out of their comfortable familiar situation. But as we learn and obtain boldness we can achieve much more and become excited about making millions instead of fearing not having the next pay check. They resist change rather than embracing and celebrating it. But your better than that.

Investing in financial IQ is one of the biggest things that can totally change your life. It will open your eyes to all the possibilities out there and will make exponential differences to how you see the world. The biggest asset you have is your mind. If you train it well it can generate millions.

When your financial IQ is developed and you understand regulations, terminology and how things work you can leverage assets and make them work for you. The author Robert Kiyosaki has many examples of selling real estate is ways that made him a lot of money all because of his financial literacy.

Left Hemisphere Moment: You can turn small amounts of money into large amounts of money by astute, well timed investment opportunities and selling moments.

Right Hemisphere Moment: Look back at your experiences and use them personal trainers. You don’t always need a teacher.

Sub-conscience Moment: We all have tremendous potential. But underlying self-doubt and fear will hold us back.

Financial intelligence is a synergy of accounting, investing, marketing and law. Many well trained professionals are one step away from big success. One well written educated newspaper journalist was offended at the advice that she should go to a sales-person school. And Robert pointed her to the his book cover. It stated “Best Selling Book” not “Best Written Book”. This was offensive to her and is a sign that we simply do not take the step necessary to be successful.

Robert suggested to her that she should have got a job at an advertising firm and worked on her book on the weekends. then she could publish the book and then become a best selling author. But she wanted to remain a newspaper columnist instead to play it safe with job security.

So the choice is job security or work to learn. That is the big choice we have to make if we want to make it to the next level.

Left Hemisphere Moment: It does not make sense to leave a well paying job to purse more knowledge, but in the long run it is worth it.

Right Hemisphere Moment: Learning skills outside your profession will benefit you.

Sub-conscience Moment: the situation you fear the most is the thing you need to conquer. It is like going to the gym, you will be glad you did it.

Fear

No one likes loosing money. But the rich are not afraid of loosing and are willing to take risks and not play it safe. Some poor people never lose a dime (investing that is).

Failure inspiring winners and failure defeats losers.

Cynicism

Whether it is doubt in ourselves or doubt in other, it keeps us from taking action. We let opportunities pass us by when they are right in front of us. Try not to let negativity stop you from taking action.

Laziness

The most common form of laziness is staying buys. No time to get financial literacy, take care of family or health. Surprising right?! Make sure you are not sing business to ignore important things in your life.

Bad Habits

Build good habits in your mind. Poor dad always wanted to pay everyone else fist and himself last to alleviate pressure. Make sure you [ay yourself fist even if money is tight.

Arrogance

Get educated in other areas other than your profession.

Left Hemisphere Moment: Analyze instead of criticize. Winners analyze, losers criticize.

Right Hemisphere Moment: Overcome bad habits. For instance, pay yourself first instead of last.

Sub-conscience Moment: Fear of failure keep most of the people out of the game. Let fear inspire you instead of stop you.

We are taught that the love of many is the root of all evil. And it is true but this mantra when not studied correctly puts people in a mindset locked in iron that keeps them afraid to keep their eyes open for great opportunities.

Find a reason bigger than reality. “The Spirit”

If you don’t have long term vision and sense of purpose behind what you are doing you wont have the passion and the drive to do what it takes to get things done.

Make Daily Choices: The Power Of Choice

Your spending habits determine who you are. Make sure you are not spending all of your money on self indulgent items. Spend money on seminars, books, CD’s learning and other vehicles that will make you money. Some can spend $350 on a seminar that can make $2 million.

Choose Friends Carefully: Power Of Association

Do not listen to the poor or freighting people. It is better to be around people who will encourage you, excite you and motivate you to be better.

Master A Formula And Then Learn A New One: Power Of Learning Quickly

Be careful what you learn and incorporate multiple formulas. Do not stick one formula the way the masses do, pay bills, taxes and personal needs. Find the other formulas that make you wealthy.

Pay Your Brokers Well

The amount of money you make from a goof broker or a good lead generator makes a big difference. If you treat them well they will bring you much more money in the long run.

Be An Indian Giver

Try to get what you put into the investment column back as fast as you possibly can

Use Assets To Buy Luxuries

We all love luxuries, but you want to make sure you are purchasing fro the overflow of you assets not from your baseline income.

Have Heroes To Look To

When you do this you tap into their genius. find people you look up to and follow their footsteps in your own unique way.

Teach And You Shall Receive: The Power Of Giving

Be generous in what you have and it will come back to you. Teach people valuable information and you will be taught what you need to know when you need it.

Left Hemisphere Moment: Use self discipline to pay yourself first.

Right Hemisphere Moment: Keep your mind open to new ideas and doing things different.

Sub-conscience Moment: Harness deep seated reasons to become rich. It will motivate you and drive you where you need to be.

Leave a Reply